child tax credit portal for non filers

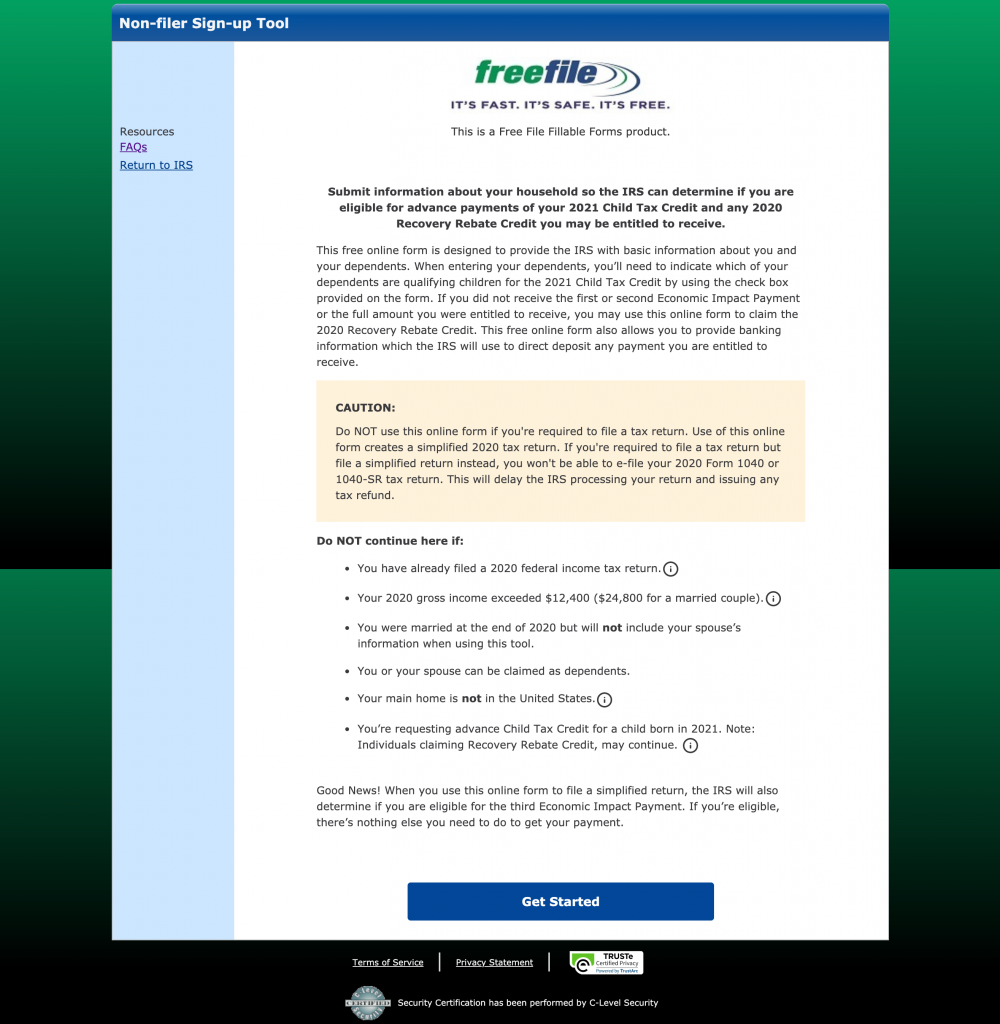

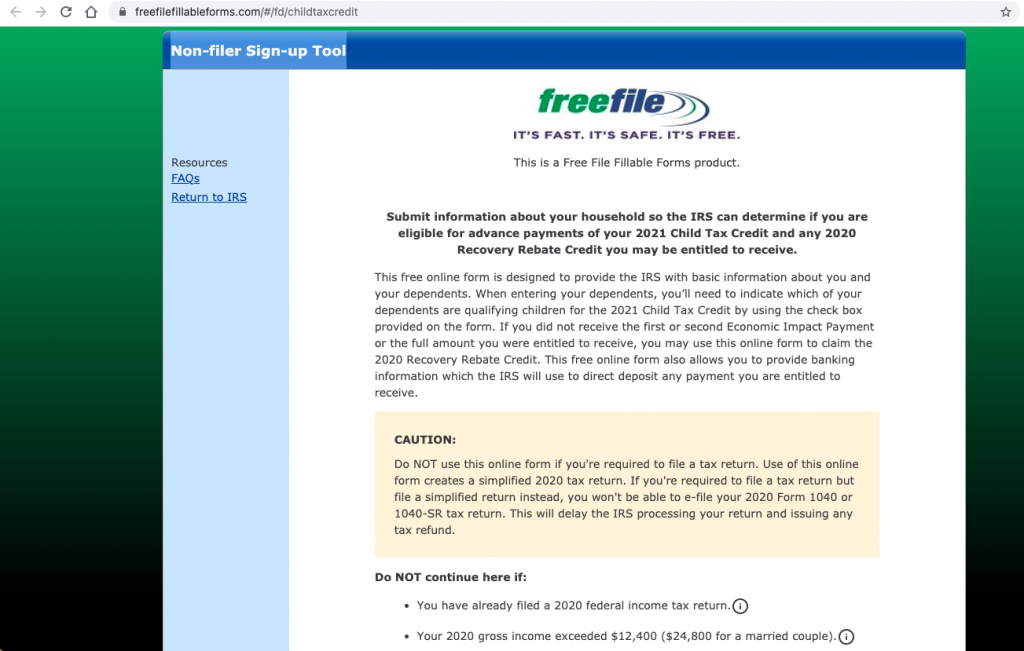

Keep reading to learn more about the child tax credit portal update. The IRS has launched their Child Tax Credit Non-filer Sign-up Tool for taxpayers to report their qualifying children born before 2021 and who also.

Irs Tool Helps Low Income Families Register For Monthly Child Tax Credit Payments Tax Pro Center Intuit

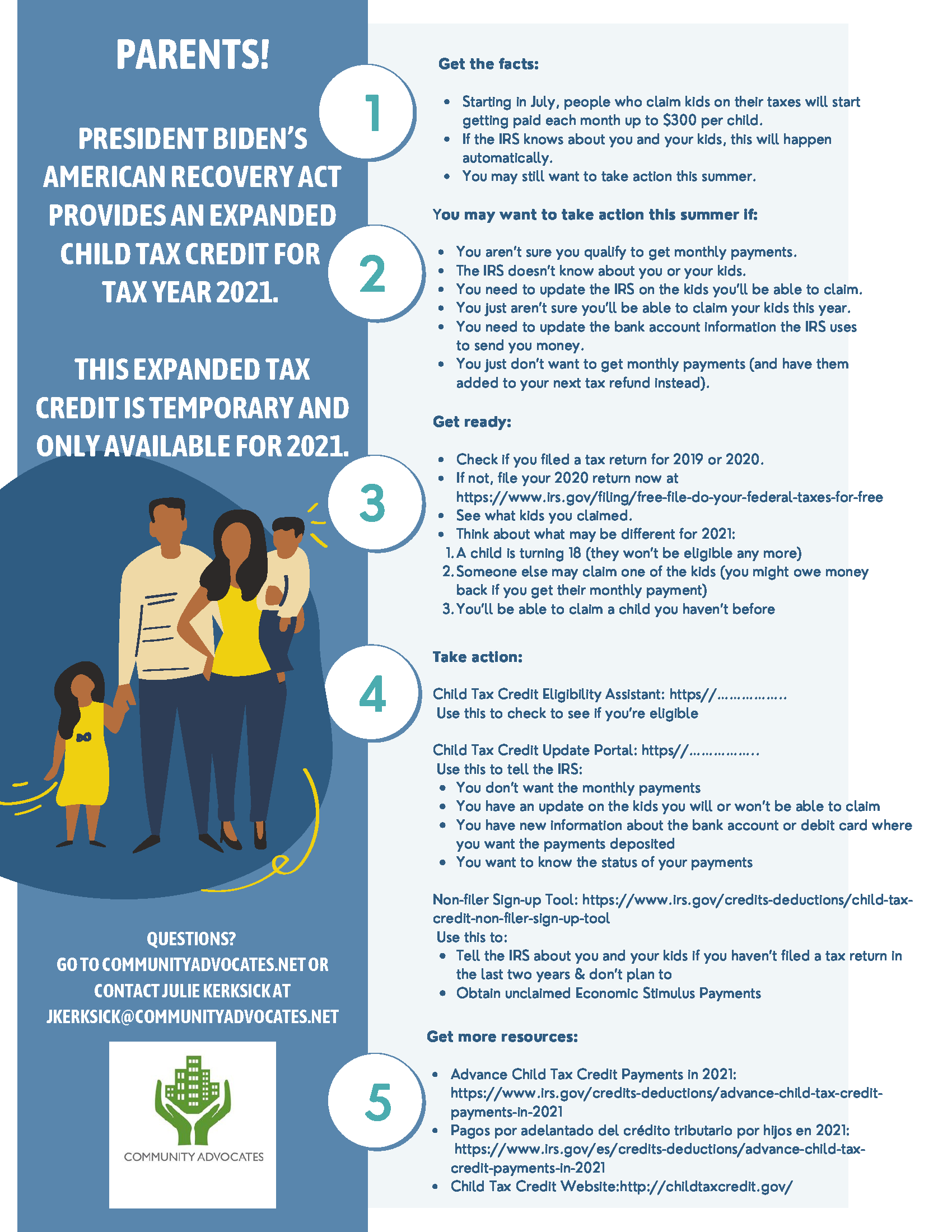

Here is some important information to understand about this years Child Tax Credit.

. Payments to b egin July 15 and w ill n ot a ffect p ublic. To sign up with the IRS non-tax-filers will need to submit their. See if you qualify using the Child Tax Credit Eligibility Assistant.

Child tax credit portal for. To sign up with the IRS non-tax-filers will need to submit their. The Child Tax Credit provides money to support American families.

THE IRS has opened an online portal allowing non-filers to register information to receive the 3600 child tax credit. The White House has put a temporary pause on the IRS Child Tax Credit tool Politico reported on March 3. Thanks to the new IRS portal non-filers can register for the Child Tax Credit online.

Internal revenue service launches web portal for child tax credit giving non filers under three weeks to declare eligibility the progressive independent. The IRS Non-filer Sign-up Tool offers a free and easy way for eligible people who dont normally have to file taxes to provide the IRS the basic information. 951 ET Jun 22 2021.

What is the Non-Filer Sign Up Tool. In June it plans to launch a portal that will allow non-filers to input their. Are not required to file a 2020 tax return.

THE IRS has opened an online portal allowing non-filers to register information to receive the 3600 child tax credit. Child Tax Credit CTC Sign-up Guide for Non-filers 3. If you dont normally file a return register with the IRS using the Non-filer Sign-up Tool.

The IRS launched two separate CTC tools by updating the current non-filer tool to include the ability to include the Child Tax Credit. The Non-filer Sign-up Tool is at. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600.

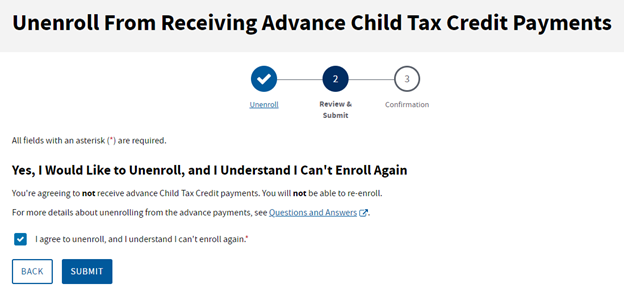

If you received any monthly Advance Child Tax Credit payments in 2021 you need to file. Its called the Non-filer sign-up tool which is for people who did NOT. Child Tax Credit CTC Sign-up Guide for Non-filers 4.

But now the IRS will make it possible for non-filers to benefit from the expanded Child Tax Credit. Filing taxes is how you receive Child Tax Credit payments that you are owed for 2021. Urges Parents to File a Federal Income Tax Return or Use Non-Filer Sign up Portal to Receive Child Tax Credit Payments.

Filed a 2019 or 2020 tax return and claimed the Child Tax. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. The non-filer portal tool was for people who do not earn enough money to file tax returns to register for the remaining money from the child tax credit.

According to the tax agency the Child Tax Credit portal was built. That meant if a family claimed the 2000 credit for a single child and owed no money to the IRS the most that family could get back in refund form was 1400. Non-filers Can Use GetCTC to Get Your Child Tax Credit.

They also launched the Child Tax Credit. Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. WASHINGTON The Treasury Department and the Internal Revenue Service today unveiled an online Non-filer Sign-up tool designed to help eligible families who dont normally.

You can use your username and password for. People who received advance CTC payments can also check the amount of their payments by using. 925 ET Jun 22 2021.

June 14 2021. The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17.

Assisting Non Filers With The Child Tax Credit Ctc Better Health Together

It Took Two Days To Make A Good Ctc Website People S Policy Project

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

Treasury Irs Announce Tool To Help Non Filers Register For Child Tax Credit The Hill

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments

Child Tax Credit Outreach Woodbridge Neighborhood Development

Child Tax Credit What We Do Community Advocates

The Child Tax Credit Non Filer Tool Is A Mess People S Policy Project

Assisting Non Filers With The Child Tax Credit Ctc Better Health Together

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Mca Ministry Corporation Nidhicompany Taxaudit Taxation Gst Incometax Incometaxindia Gstcouncil Co Chartered Accountant Tax Advisor Business Updates

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Families Receiving Monthly Child Tax Credit Payments Can Now Update Their Direct Deposit Information The Georgia Virtue

November 15 2021 Deadline For Non Tax Filing Families To Use Child Tax Credit Portal Lone Star Legal Aid

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Ensuring Families Who Qualify For The Child Tax Credit Aren T Left Behind Code For America

Child Tax Credit Update Irs Launches Two Online Portals

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver